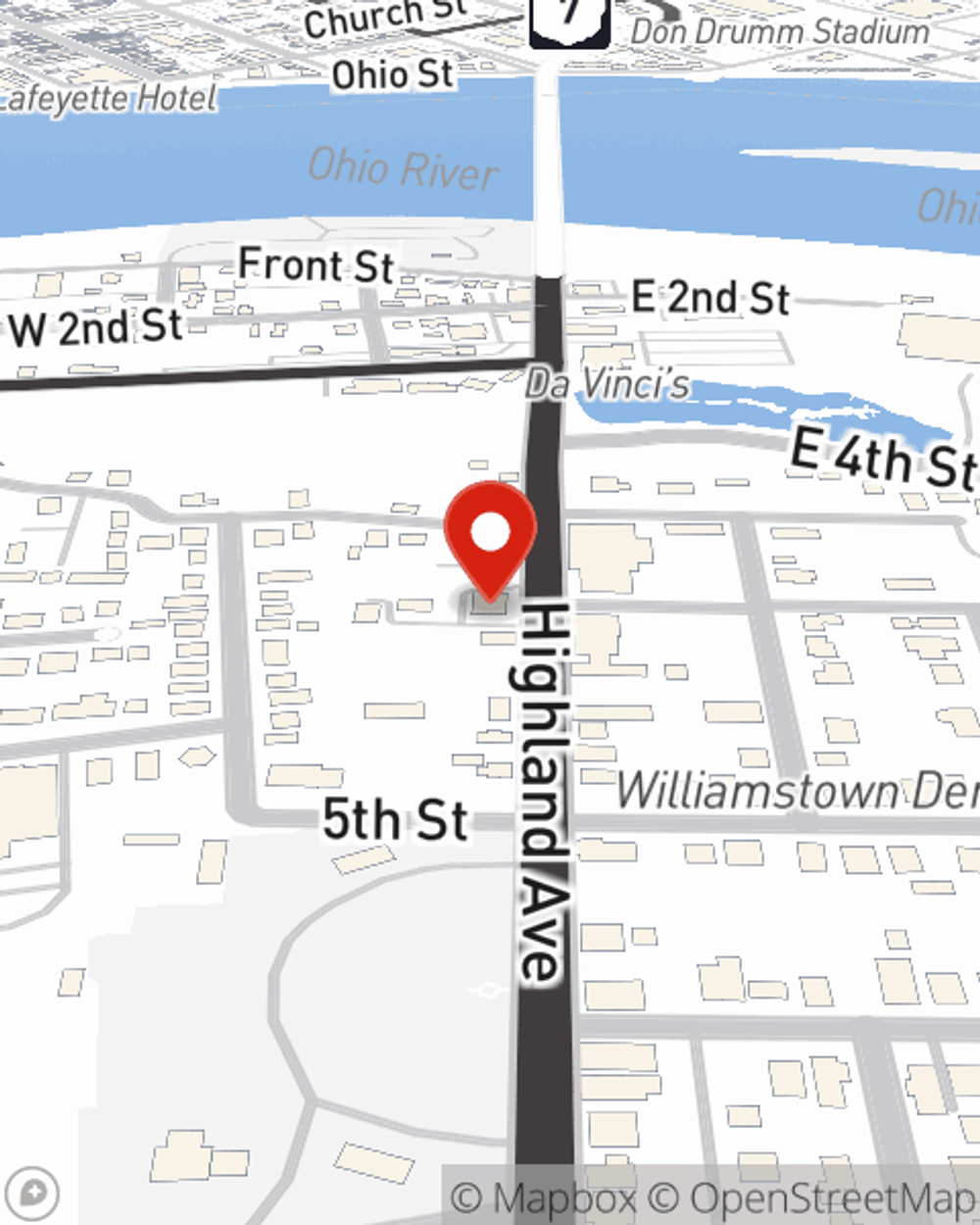

Renters Insurance in and around Williamstown

Your renters insurance search is over, Williamstown

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

There’s No Place Like Home

No matter what you're considering as you rent a home - furnishings, location, number of bedrooms, apartment or house - getting the right insurance can be essential in the event of the unanticipated.

Your renters insurance search is over, Williamstown

Coverage for what's yours, in your rented home

There's No Place Like Home

When the unanticipated fire happens to your rented condo or space, generally it affects your personal belongings, such as a video game system, a cooking set or a bicycle. That's where your renters insurance comes in. State Farm agent Tyler Shank is passionate about helping you evaluate your risks so that you can insure your precious valuables.

It's never a bad idea to be prepared. Reach out to State Farm agent Tyler Shank for help understanding savings options for your rented property.

Have More Questions About Renters Insurance?

Call Tyler at (304) 200-2270 or visit our FAQ page.

Simple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.

Tyler Shank

State Farm® Insurance AgentSimple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.